Fast, Accurate Fixed Asset Accounting for Restaurants

Take control of your restaurant’s fixed assets with R365’s powerful tracking and management tools. From monitoring the lifetime costs of equipment to automating depreciation, R365 simplifies fixed asset management across all locations.

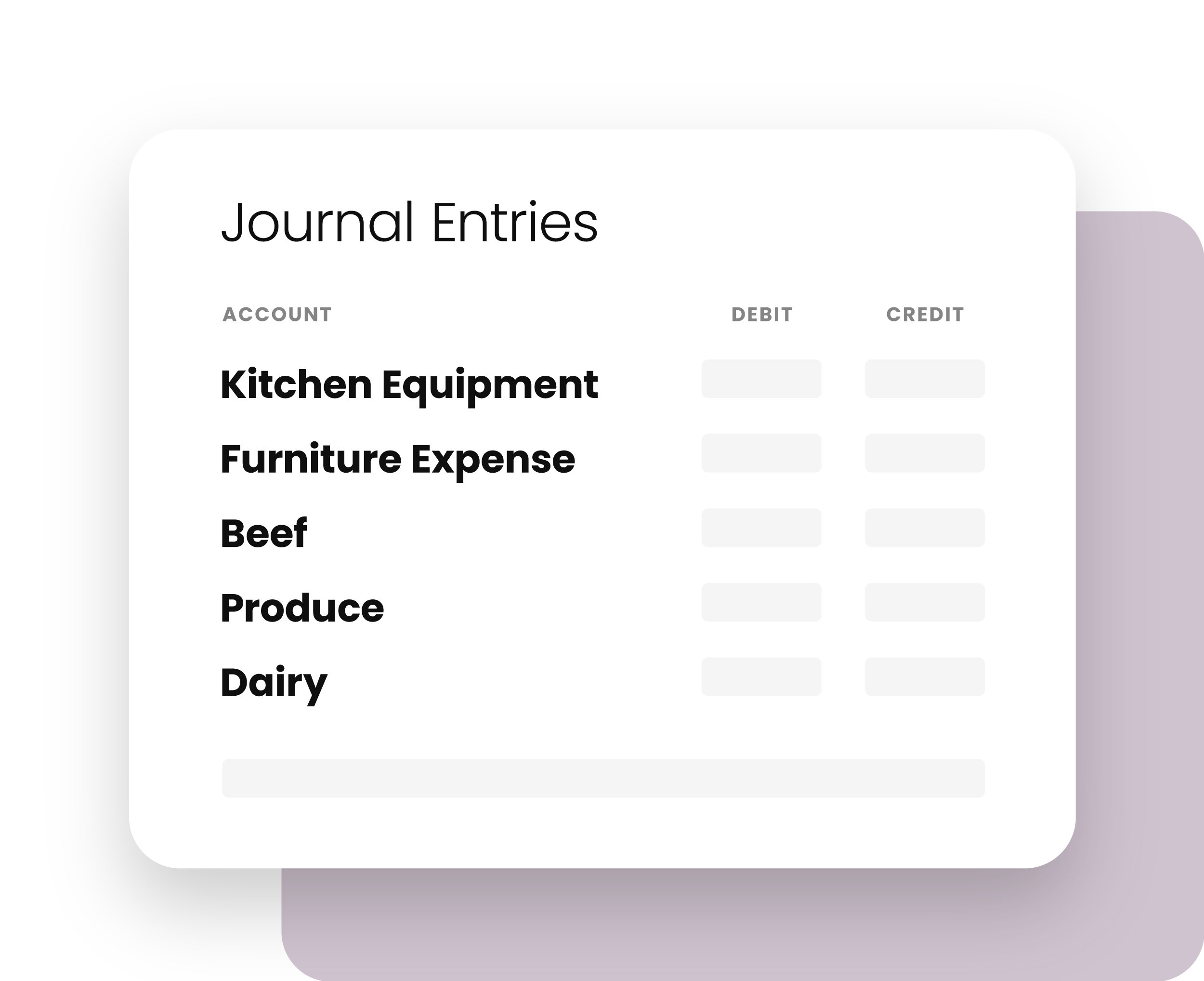

Easily Track Fixed Asset Categories

With R365 fixed asset software, you can record purchases, track assets, and manage depreciation automatically, saving time and ensuring accuracy.

- Easily track the lifetime costs of all fixed assets, including real property, technology, kitchen equipment, and furniture.

- Monitor construction costs with ease, ensuring accurate financial tracking.

- Track asset costs on a store-by-store basis for detailed financial insight.

Automated Depreciation Made Simple

R365 fixed asset accounting provides a centralized platform for managing a restaurant’s physical assets. Whether it’s a grill, furniture, or technology, track every detail and maintain accurate records effortlessly.

- Automatically depreciate all assets based on configured classes and categories.

- Record the Placed In Service Date and mark assets as Active for seamless tracking.

- Retire old assets easily using the depreciation form, ensuring records are always up to date.

Streamlined Asset Management

R365’s Fixed Assets module simplifies the process of managing long-term physical assets at restaurant locations. Keep everything organized for precise tracking and smarter financial decisions.

- Track and manage all long-term physical items across locations.

- Monitor each item’s status, cost, and depreciation.

- Keep asset records organized and up-to-date.

The adaptability and innovations of Restaurant365 are extremely important to me. I always want to be working with a company that truly serves its customer by making managers’ jobs and the company’s job easier.

Walid Jamal,

President

JHG Restaurants

FAQ

Get answers to the questions restaurant accounting teams most frequently asked about fixed asset management.

How can I accurately track the depreciation of my restaurant’s fixed assets?

Restaurant365’s Fixed Asset Management module allows you to manage depreciation schedules by providing customizable asset classes and with the widely used straight-line method. Our solution enables you to monitor asset lifecycle, depreciation schedules, and maintenance records, ensuring that your assets are properly accounted for.

Does Restaurant365 support multiple locations in tracking fixed assets?

Absolutely! R365 is designed to manage fixed assets across multiple restaurant locations. Our centralized platform allows you to track asset allocation, transfer, and depreciation by location, giving you a clear overview of your assets’ value across your entire organization. This is particularly beneficial for multi-unit operators looking to streamline asset management and optimize resource allocation.

What types of assets can I track within R365’s Fixed Asset Management module?

R365 supports the tracking of a variety of fixed assets, including equipment, vehicles, leasehold improvements, and furniture. You can categorize assets into customizable classes, assign them to specific locations, and monitor their value over their lifecycle. This flexibility allows you to maintain a detailed and organized asset register. Additionally, R365 allows you to track expenses related to assets to provide further insight.

Can I generate reports on my restaurant’s fixed assets for audits or reviews using R365?

Yes, R365 provides the ability to generate detailed reports on your fixed assets, including acquisition costs, depreciation history, and asset value. These reports are essential for audits, financial reviews, and tax preparation, ensuring that you have all the necessary information at your fingertips

Take Charge of Your Fixed Assets

Streamline your restaurant's asset management with R365’s comprehensive tracking and automated depreciation tools.