As a restaurant operator, you may not have control over staff turnover or a new restaurant opening next door, but if you’re serious about achieving your profit margins, you need to have daily access to the data that allows you to manage what you can control – your restaurants’ prime cost.

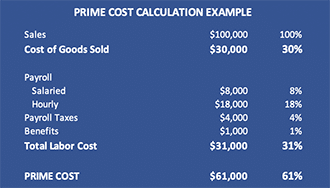

Because labor costs can vary greatly between fine dining, fast casual and quick-serve restaurants, the prime cost is a better indicator of whether your restaurants are achieving acceptable margins. Prime cost is your cost of goods sold (food and beverage) plus labor costs, and, typically, restaurateurs aim to keep this figure no higher than two-thirds of sales. Some industry-standard benchmarks go as low as 60 percent of sales, but what all restauranteurs can agree on is that restaurant margins are thin. The latest, restaurant-specific accounting and operations technology can help you control prime cost and increase your margins.

Because labor costs can vary greatly between fine dining, fast casual and quick-serve restaurants, the prime cost is a better indicator of whether your restaurants are achieving acceptable margins. Prime cost is your cost of goods sold (food and beverage) plus labor costs, and, typically, restaurateurs aim to keep this figure no higher than two-thirds of sales. Some industry-standard benchmarks go as low as 60 percent of sales, but what all restauranteurs can agree on is that restaurant margins are thin. The latest, restaurant-specific accounting and operations technology can help you control prime cost and increase your margins.

Using a restaurant-specific software platform that’s integrated with your Point-of-Sale (POS) system and your vendors, you can run a daily controllable income report that reflects all the expenses that you and your restaurant managers have control over – labor costs and costs of goods sold (COGS). You and your store managers can use this data to make smart and timely decisions on staff scheduling, inventory, ordering, menu offerings and more, allowing corrections to problems that could have a negative impact if not caught and rectified immediately. Your restaurant accounting platform should allow your restaurant managers access to COGS even if the food and beverage invoices are not received at the store level.

KEEPING TABS ON YOUR LABOR COSTS

Some restauranteurs include only the direct labor costs of scheduled shifts (unburdened labor) to calculate prime cost, while others include payroll, payroll taxes, worker’s comp, medical insurance and other employee benefits (fully burdened labor). Your restaurant accounting software should allow you the option to use either unburdened labor or burdened labor to calculate your prime cost, giving you a full view of your labor costs and avoiding any unwelcome surprises later.

Equipped with daily labor costs through integration with your POS system, you can see if you’ve exceeded your benchmarks and make adjustments accordingly. If you’re using legacy accounting systems that do not integrate with your POS system these daily reports are either impossible or extremely burdensome. Consequently, if you’re only reviewing labor costs on a monthly basis, and you discover that you didn’t meet your labor cost benchmark because several employees were clocking in early and/or clocking out late by approximately 15 minutes per day, for example, that can add up significantly over a month’s time. Letting a few hours of payroll slip through the cracks once may not have a major impact, but consistently paying more than necessary in hourly wages for an entire month could put a crimp in your bottom line. In addition to allowing you to review and adjust labor costs on a daily basis, a restaurant accounting software scheduling function that restricts employees from clocking in/clocking out outside of their scheduled time helps to control these excess labor costs. Running a daily punch detail report will help your managers stay informed on the labor data from your POS compared to the hours scheduled.

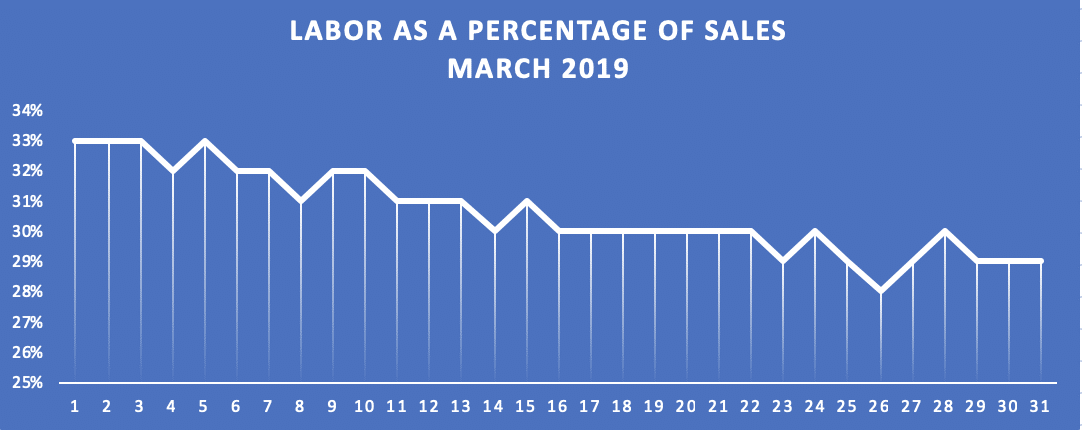

Another way to save is to run a daily report that calculates labor costs as a percentage of revenue. This allows the restaurant manager to make scheduling changes based on this immediate feedback to improve your labor percentage starting today, rather than a week or month from now. Your restaurant accounting system should also allow you to enter your sales per labor hour goals and suggest the number of hours you should be scheduling. Labor is your most controllable cost, so tracking it data daily helps your managers stay focused on controlling it.

A good, restaurant-specific accounting and operations platform should also project labor profitability and create staff schedules based on weather forecasting and local events.

TRIMMING YOUR COST OF GOODS SOLD

A daily review of the COGS prime cost will make your restaurant managers aware of problems immediately, allowing them to respond accordingly. You’ll find that daily food costing can result in significantly reducing your COGS.

You’ll also enjoy a better food inventory turn if your back office restaurant technology includes such functionality as stock count tracking and waste logs, as well as interactive, real-time theoretical versus actual reporting.

With a comprehensive restaurant-specific accounting and operations platform, these are some other ways you can reduce your food costs:

- Get a snapshot of your actual vs. theoretical food costs

- Track vendor contract pricing to compare what you received vs. what you paid

- Use suggestive ordering to purchase inventory at the right level to reduce over ordering and food waste

- Use menu engineering to determine the profitability and popularity of a menu item

- Track and properly account for food borrowed between locations

SUMMARY

By choosing a restaurant-specific accounting and operations solution you control prime cost by easily accessing actionable data on a daily basis. You can become a data-driven restauranteur, making smart decisions based on real-time information about your labor costs and cost of goods sold.

Restaurant365 is an accounting and back office platform created specifically for the restaurant industry. Restaurant365 is a fully integrated, restaurant-specific solution for accounting – including AP automation — plus inventory, scheduling and more. The cloud-based platform connects to your Point-of-Sale system, as well as to your food and beverage vendors, payroll vendor and your bank for automated bank reconciliation.

To learn more, schedule a short demo.

# # #

Joe Hannon is product owner, operations, at Restaurant365, where he works with the design and development teams to convert customer-generated ideas into usable product features and functionality. Prior to joining Restaurant365, he held management positions at several restaurants, including seven years as assistant general manager at Jason’s Deli, a fast-casual restaurant group with 268 locations in 29 states.